This year is flying by fast! I cannot believe we are already halfway through 2024 and steadily marching towards 2025 – eek! Given this, now seems like a good time to review what happened last financial year and look into the future to consider what might happen in the second half of 2024 as we hurtle towards 2025!

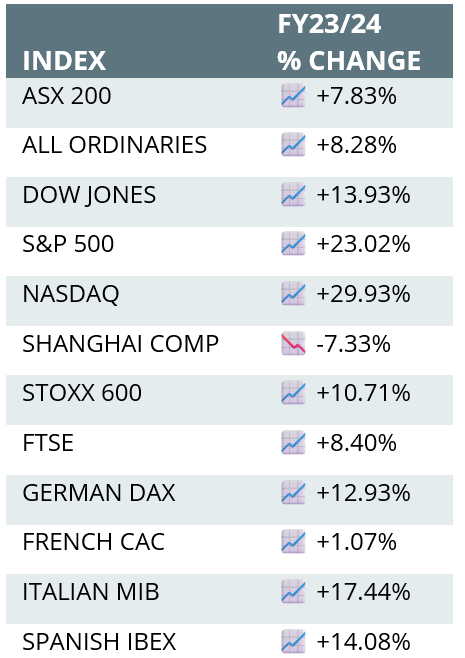

All said and done, the 2023/24 financial year was a good one. The table below reveals that international stocks, particularly big tech (driven by AI), were the standout. China continued to suffer from its domestic issues. Australia was solid, with banks being the standout (+23.1%), while the resources sector struggled (-7.74%), likely reflecting the problems in China.

So, what is the outlook for the rest of 2024? I think caution is still warranted. There is going to be a lot going on in the second half of 2024. I think the US is done with interest rate rises, but how far away rate cuts are, and their size is another question. I don’t think they will cut rates this year, but if they do, it will be minimal (25bps max). They also have their political situation to sort out.

The latest inflation data in Australia indicates that interest rate cuts are also unlikely here. In fact, the market is starting to price in a 25bps rise in August. Whilst I am a huge fan of Michelle Bullock, I don’t think they are going to do it. Unfortunately, I think the RBA made a strategic error in not raising rates enough when they had the chance. Our rate increases were lower than those of our global counterparts, likely driven by political pressures (from both sides) to maintain the housing boom. Now, we are paying the price. Everybody knows interest rates are a blunt instrument and their effects take a long time to filter through the economy. This transmission mechanism has been further hampered by governments throwing money at everyone during Covid which resulted in large personal savings that people have been using to support their lifestyles for the last couple of years. It seems to me that those savings cushions are finally being depleted. My guess is, and the RBA knows it, that a rate rise now after such a long pause would be psychologically damaging to the population. I feel sorry for these people because they merely followed the RBA’s signal, borrowing to the hilt and believing the RBA when it said there would be no rate rises until 2024. Clearly, the RBA was wrong, and if they raise rates again, people will pay the price.

I think higher interest rates are starting to take effect. Anecdotally, I have noticed a slow down around my local area: some cafes and bars are closing, everything in Myer is regularly on sale, the last 6 flights I have taken have been less than half full and taxi drivers are polite and more than happy to take a short fare! But that said there still a lot of money flying around out there. There are lots of Australian’s still doing well.

Inflation and the resulting course of interest rates will be the key factors to watch. I don’t anticipate interest rates coming down in Australia; in fact, there is a slim chance they might go up. People are running out of cash buffers, businesses are tightening their belts, and conditions are about to get tougher. Investors should be cautious. Review your portfolios carefully and be very clear about what you have invested in and why. Be especially cautious with illiquid investments such as private credit (you can read more about my views on this here).

P.S. On a side note, against my thesis, Guzman y Gomez (GYG) listed and has had a flying start. I saw a meme that was trying to explain their strong performance saying, “maybe they have AI in the gauc”. I laughed hard. Maybe I am wrong and maybe they do. I am still not a believer at these valuations but, hey, time will tell.

Kind regards,

Shelley Marsh

Outsourced Chief Investment Officer (OCIO) & Founder

Wealth Differently

General Advice Warning: Wealth Differently holds an Australian Financial Services licence to provide services to wholesale clients only. The information on this website is only for persons who are wholesale clients as per s761G of the Corporations Act. The information includes general advice which does not consider your particular circumstances and you should seek advice from Wealth Differently who can consider if the strategies and products are right for you. You should also understand that past performance is often not a reliable indicator of future performance and should not be solely relied upon to make investment decisions.

Wealth Differently Pty Ltd AFSL 547820.