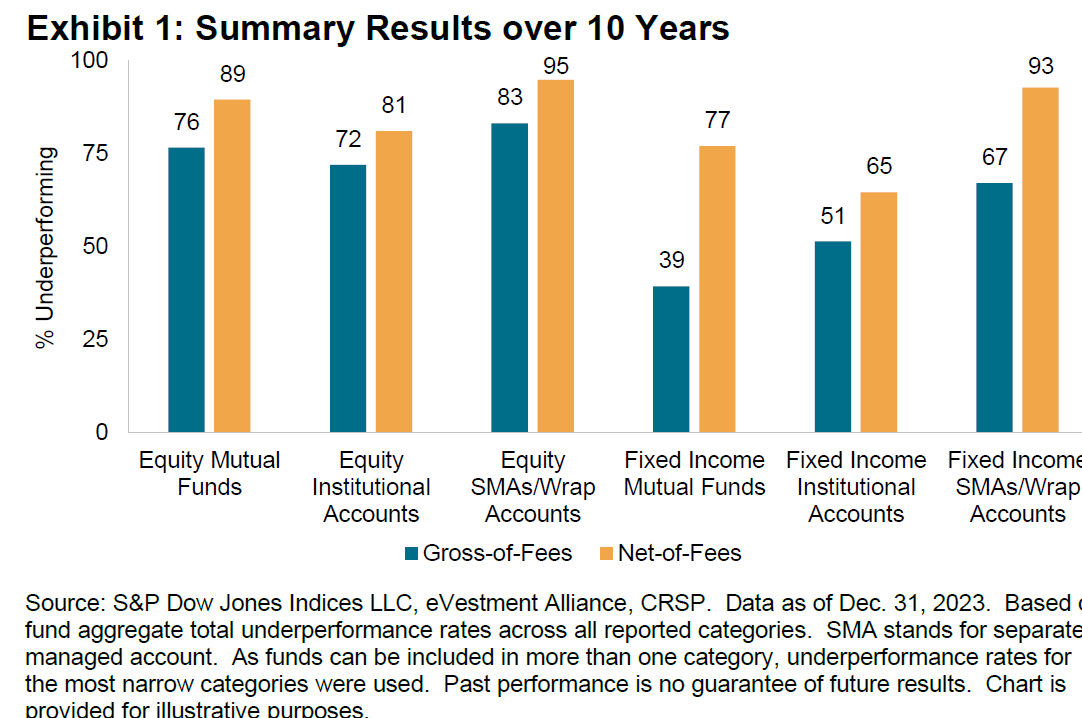

A couple of weeks ago, the latest SPIVA data was released on the performance of institutional fund managers in the US. The findings were horrifying. The data reveals that over 70% of equity funds underperformed their respective benchmarks over the 10-year period ending Dec. 31, 2023. After accounting for fees, the rate of underperformance rose to over 80%! Ouch!

There were a few nuances in the data: small and mid-cap managers had significantly lower underperformance rates compared to large-cap managers. Interestingly, fixed income managers also had lower underperformance rates before fees, but the impact of fees was much higher post-deduction. You can see the detailed charts below and click here to read the full SPIVA paper.

I’d love to tell you that this data is only relevant to US investment managers, but unfortunately, SPIVA conducts similar surveys worldwide, including in Australia, and the results are largely the same. Over a 10-year period, most active managers underperform their benchmarks, especially after fees. As I said – horrifying!

What does it all mean?

Most managers are polished, with great stories and marketing. Your job (and definitely mine) is to dig into the details and find the truth. Performance is key. The SPIVA data shows the importance of being discerning about your investments. You need to be clear about what you’re investing in, who you’re investing with, the costs involved, and have a formal review process to ensure your investments meet expectations over time. Mistakes happen, but a formal review process helps catch them and prevents you from staying in poor-performing investments for too long. Life’s short—invest well!

If you’d like to read more of my views on performance and fees click here.

Kind regards,

Shelley Marsh

Outsourced Chief Investment Officer (OCIO) & Founder

Wealth Differently

General Advice Warning: Wealth Differently holds an Australian Financial Services licence to provide services to wholesale clients only. The information on this website is only for persons who are wholesale clients as per s761G of the Corporations Act. The information includes general advice which does not consider your particular circumstances and you should seek advice from Wealth Differently who can consider if the strategies and products are right for you. You should also understand that past performance is often not a reliable indicator of future performance and should not be solely relied upon to make investment decisions.

Wealth Differently Pty Ltd AFSL 547820.